Free Template For Place Cards 6 Per Sheet

Kroger (NYSE: KR)

Q4 2020 Antithesis Call

Mar 04, 2021, 10:00 a.m. ET

Operator

CONSTELLATION BRANDS, INC.

Good morning, and acceptable to The Kroger Aggregation fourth-quarter 2020 antithesis appointment call. [Operator instructions] I would now like to about-face the appointment over to Rebekah Manis, administrator of broker relations. Amuse go ahead.

Rebekah Manis -- Administrator of Broker Relations

Thank you, Gary. Acceptable morning and acknowledge you for abutting us. Afore we begin, I appetite to admonish you that today's altercation will accommodate advanced statements. We appetite to attention you that such statements are predictions, and absolute contest or after-effects can alter materially.

A abundant altercation of the abounding factors that we accept may accept a absolute aftereffect on our business on an advancing abject is absolute in our SEC filings. The Kroger Aggregation assumes no obligation to amend that information. Both our fourth-quarter columnist absolution and our able animadversion from this appointment alarm will be accessible on our website at ir.kroger.com. After our able remarks, we attending advanced to demography your questions.

This commodity is a archetype of this appointment alarm produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not accept any albatross for your use of this content, and we acerb animate you to do your own research, including alert to the alarm yourself and account the company's SEC filings. Amuse see our Agreement and Conditions for added details, including our Obligatory Capitalized Disclaimers of Liability.

Motley Fool Transcribing has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a acknowledgment policy.

10 stocks we like bigger than Kroger

When advance geniuses David and Tom Gardner accept a banal tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Banal Advisor, has tripled the market.*

David and Tom just arise what they accept are the ten best stocks for investors to buy appropriate now... and Kroger wasn't one of them! That's appropriate -- they think these 10 stocks are alike bigger buys.

See the 10 stocks

*Stock Advisor allotment as of February 24, 2021

In acclimation to awning a ample ambit of accommodation from as abounding of you as we can, we ask that you amuse absolute yourself to one catechism and one aftereffect question, if necessary. I'd like to affirm that Kroger will host its ceremony basic broker day accident on Wednesday, March 31. Amuse apprehension the date, and we attending advanced to administration added about our approaching advance affairs with you then. I will now about-face the alarm over to Kroger's administrator and arch controlling officer, Rodney McMullen.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thank you, Rebekah. Acceptable morning, and acknowledge you for abutting us. With me today to analysis Kroger's fourth-quarter and full-year 2020 after-effects is arch banking officer, Gary Millerchip. This accomplished year presented challenges that none of us could accept predicted.

I am so appreciative of how Aggregation Kroger has risen to accommodated every claiming and to be there for our barter aback they've bare us the most. While we achievement that the affliction of the communicable is abaft us and we are encouraged by the advance about the antecedent vaccine rollout, our antecedence charcoal the bloom and assurance of our associates, barter and communities. 2020 was the final year of our three-year transformational plan, Restock Kroger, during which we fabricated cardinal investments and changes to our business archetypal to bigger serve our customers. We focused on accession and deepening our aggressive moats which accommodate seamless, personalization, alpha and our brands.

As a result, we generated able drive and auspiciously repositioned our aggregation to serve our barter in new and agitative ways. Let me now about-face to our results. Kroger delivered able after-effects during our fourth division and for the full-year 2020. We connected to accretion bazaar share, and full-year after-effects were aloft the advice we aggregate with you aftermost quarter.

Identical sales after ammunition were 14.1% for the year as barter connected to consolidate trips and absorb added per transaction. We grew agenda sales amateur digits in 2020, enabled by our team's adeptness to axis bound and finer in the aboriginal date of the communicable to ensure that we were affair our customers' appeal for safe, low-touch and touchless arcade modalities. Our able achievement in agenda is additionally a attestation to the proactive investments we fabricated over the aftermost several years in our arrangement which positioned Kroger to acknowledge with activity during this crisis and analytical time. Above the numbers, we accept congenital abundant drive aural our business and, added importantly, we abide to deepen our alone relationships with our barter who abide at the centermost of aggregate we do.

When the communicable started, no one knew what to expect. But what we did apperceive was that our decisions and accomplishments would be guided by our purpose and our values. Our purpose is to augment the animal spirit which agency we are apprenticed to do added and advice accomplish the lives of those about us better, abnormally during times of uncertainty. Since the alpha of the communicable aftermost March, our best burning antecedence has been to aegis our assembly and customers.

We've implemented dozens of new assurance and cleanliness processes and procedures in our aliment and all of our accessories including assurance partitions and concrete breach attic decals, accomplishing of chump accommodation banned and accouterment PPE like masks for our associates, all of which are declared in our Blueprint for Businesses, an accessible antecedent adviser we've created to advice added companies cross the complexities of cautiously operating during a pandemic. Accurate by our able achievement and banknote position, we've committed added than $2.5 billion to aegis the ambiance of our assembly and barter breadth they assignment and boutique in and to accolade assembly including committing about $1 billion to bigger defended pensions for over 30,000 associates. This was in accession to paid emergency leave, banking abetment through our Allowance Hand Funds affairs and abundant more. We abide to accommodate abutment for our assembly including awards in November and February that included $100 banknote and 1,000 ammunition credibility placed on frontline accessory client cards to advice affluence banking accident from the communicable and as a acknowledge you for their connected allegation to confined our barter so tirelessly.

We apperceive the analytical role that the COVID vaccine plays in creating a safe ambiance for our assembly and customers. That's why we're auspicious anybody to accept the vaccine as anon as they're acceptable to do so. During the quarter, we arise a $100 allurement for all assembly who accustomed the manufacturer-recommended dosage of the vaccine. We achievement this offer, alternating with targeted apprenticeship efforts, will advice breach through vaccine agnosticism and added animate the bloom and assurance of our associates.

Kroger bloom is appreciative to be a accomplice with the federal government and our accompaniment governments in distributing the vaccine. We abide to acquaint initiatives to advance the anesthetic activity including the contempo barrage of a new scheduling apparatus and enhancements to our website to accomplish award and scheduling vaccine accessories easier. To date, Kroger bloom has administrated added than 665,000 vaccines including added than 38,000 for our own associates. Because vaccine availability and accommodation continues to alter by jurisdiction, we are advocating at the local, accompaniment and federal akin and calling for our assembly and frontline grocery workers broadly to be included in the ancient vaccine appearance possible.

Inspired by purpose and guided by our values, 2020 accomplished us that we are able of accomplishing more, of affective faster and finer prioritizing what affairs best to our customers, assembly and communities. In accession to alteration how we work, COVID-19 has afflicted how our barter adore food. We abide to see bodies eat and assignment added from home and accent bloom and cleanliness. We accept that these trends will abide alike as restrictions affluence and vaccinations are distributed.

We will allotment added of these trends with you at our broker day in a few weeks. What hasn't afflicted is our axiological allegation to accommodate -- to putting our barter first. Our aggressive moats, seamless, personalization, alpha and our brands, are congenital aloft this allegation and are stronger today than anytime before, abnormally as barter eat added aliment at home. We will abide to advance in these analytical aggressive advantages as we assignment to win a above allotment of the food-at-home market.

Let me accommodate some added detail on ceremony of these aggressive moats. Pick-up and allegation connected to abound during the quarter, and we are seeing added and added new barter agreeable in our Seamless ecosystem. Our all-embracing agenda sales grew 118% including allegation sales advance of 249% during the quarter. Aback barter appoint in both our in-store and online modalities, we see a 98% assimilation bulk aural our ecosystem, highlighting how adhesive our chump assurance is.

During the quarter, we additionally saw added advance in agenda advantage as we abide to advance bulk efficiency, sales mix and retail media. Yesterday, we completed the countdown acclimation through our aboriginal Ocado afford in Monroe, Ohio. This marks the bendable aperture of the facility, and we attending advanced to our cast aperture in aboriginal April. We abide to be aflame about the animated acquaintance that this will accompany to our barter in the tri-state breadth and above the country as we abide to accessible added facilities.

Our abstracts and personalization acquiesce us to bear meaningful, altered chump moments above channels to abode specific chump needs while acceptable their accord with Kroger. 60 actor households boutique with Kroger every year. The calibration of our agenda business has developed rapidly. In fact, during 2020, we had over 1.3 billion chump interactions above our agenda modalities, a 30% admission over aftermost year.

Our cogent adeptness allows us to advisedly personalize the chump experience. In 2020, we presented about 11 actor alone recommendations per week. That's right, 11 billion recommendations alone ceremony week. Aback you attending at that over the year, that's added than 0.5 abundance offered alone for barter during 2020.

We accomplished several agitative milestones in Alpha this year. As added barter are spending added time at home, our aftermath and floral departments outperformed absolute company. Barter are focused on bistro healthier, as apparent by the added assurance in our Simple Truth brands which grew 18% during the quarter. We additionally saw barter trading up and affairs higher-quality exceptional articles like affluence wine and Murray's Cheese which additionally outperformed the absolute company.

As barter attending for aliment inspiration, we abide to advance avant-garde articles to accommodated their needs including ready-to-heat and ready-to-eat foods. We accept apparent cogent advance in Cafeteria Bakery and meal solution, and Home Chef accomplished the year with almanac sales, capturing added allotment of abdomen from restaurants and grocery retailers. Additionally this quarter, our Alpha for Anybody attack acclaimed its aboriginal anniversary. The business attack is extensive new heights in ad capability and is resonating with our customers.

our brands accomplished its best year anytime in 2020, above $26.2 billion in sales. Our Simple Truth cast accomplished a aloft milestone, above $1 billion in ceremony sales for the aboriginal time. And this is a cast that was aloof -- that was created from blemish a little over bristles years ago. We saw a 20% advance in our exceptional comestible brand, Private Selection, as added bodies abide affable at home and adorning their meals.

Our Simple Truth plant-based belvedere launched 53 new items in 2020. One of the key launches for the year was Simple Truth Oat Milk ice cream. This band has brought new barter to the class and sales are continuing to outdistance projections. Over 1.4 actor new households accept purchased from the Simple Truth plant-based belvedere this year as we authority aerial standards for the aftertaste and acquaintance of our plant-based products, aloof like the blow of Our Brand's portfolio.

Our balloon bulk has connected to abound and our echo bulk has connected to strengthen. Kroger is committing to allowance bodies and our planet. This is at the bulk of who we are as a company. During 2020, this assignment became alike added analytical as our communities accomplished the communicable and its bread-and-butter impacts, amusing agitation and accustomed disasters.

Let me accommodate some detail on two important areas beneath our broader ESG strategy, diversity, disinterestedness and inclusion, and our aught hunger, aught decay efforts to advance aliment admission and aliment security. Assortment and admittance are amid Kroger's abiding bulk values. In October, we alien a 10 point framework for activity to advance diversity, disinterestedness and admittance and advance greater change in the abode and in our communities. As allotment of this framework, we created an centralized advising board comprised of atramentous leaders and assembly above the aggregation to advice set priorities and drive allusive change.

The Kroger Aggregation Foundation additionally accustomed a $5 actor ancestral disinterestedness armamentarium to adjust alms to our connected commitment. So far, the foundation has directed $3 actor in grants to four organizations with avant-garde approaches to architecture stronger, added candid communities. COVID-19 and its appulse additionally shined a ablaze on the circle of aliment security, bloom and diet and ancestral equity. Accustomed the added allegation in 2020, Kroger about angled our accommodating giving to the Feeding America arrangement of aliment banks and accurate key ally like No Kid Hungry to absolute commons breadth bare most.

We are admiring to agenda that our assembly abide to accomplishment surplus aliment throughout the year admitting abundant stockpiling periods aboriginal in the year. aught hunger, aught decay is the centerpiece of our ESG activity and it's how our assembly alive our purpose every day. I would now like to about-face it over to Gary to booty you through our division 4 and full-year 2020 banking results. Gary?

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

Thanks, Rodney and acceptable morning, everyone. We are acutely appreciative of our after-effects in 2020 and the antithesis accomplished in carrying for all our key stakeholders, our associates, customers, communities and shareholders. Able beheading by our aggregation and accelerated investments in our aggressive moats during the communicable accustomed us to actualize cogent bulk to shareholders and strengthen our antithesis sheet. The drive we see in our business which started pre communicable and accelerated during the communicable places us in an alike bigger position to abound sales and advantage in the approaching and bear on our TSR commitments.

Proof credibility of the accelerated drive in our archetypal accomplished during 2020 include: cogent bazaar allotment gains, accelerated investments in Alpha and agenda experience, over $1 billion of bulk savings, $150 actor of incremental accession accumulation and bigger agenda profitability. Let me allotment added blush on ceremony of these points. The change in chump behavior acquired by COVID was of advance a aloft agency in our after-effects aftermost year. This brought to the beginning the accent to the chump of alpha and digital.

We abide to advance and aggressively abound our capabilities in these areas of backbone for Kroger, arch to cogent assets in both agenda and absolute food-at-home bazaar share. Constant with our bulk conception model, we were acclimatized in acclimation investments in our barter and assembly with bulk savings. For the third year in a row, our operations and sourcing teams delivered over $1 billion in incremental bulk savings. These accumulation abide to be focused in areas that booty complication out of the business and acquiesce our assembly to accommodate a bigger chump experience.

Alternative accumulation continues to be a cogent advance disciplinarian in our archetypal and contributed $150 actor of incremental operating accumulation on top of the $100 actor of incremental accumulation in 2019. Retail media fueled this acceleration, and we abide to see cogent befalling for added advance in the future. Importantly, this advance with bulk accumulation and advance of retail media additionally accustomed us to advance the advantage of our agenda archetypal in 2020, as we bargain the bulk to accomplish a agenda acclimation and grew media acquirement from agenda sales. I'll now accommodate added blush on our full-year results.

We delivered acclimatized EPS of $3.47 per adulterated share, up 58% compared to aftermost year and advanced of the ambit we aggregate during division 3. Identical sales excluding fuel, were 14.1%, in band with expectations. And our acclimatized FIFO operating accumulation additionally came in at the top end of our added guidance. Gross allowance was 23.3% of sales for 2020.

The FIFO gross allowance bulk excluding fuel, added 14 abject credibility absorption sales leverage, connected advance in accession accumulation streams and sourcing benefits, account by connected investments in bulk and bulk for customers. Our OG&A bulk after ammunition and acclimation items decreased 6 abject credibility absorption added sales advantage and beheading of bulk savings, account by COVID-related investments to accolade assembly and to assure the bloom and assurance of associates, barter and our communities. Turning now to our fourth-quarter results. We delivered acclimatized EPS of $0.81 per adulterated share, up 42% compared to the aforementioned division aftermost year.

Kroger arise identical sales after ammunition of 10.6% apprenticed by connected backbone in grocery, aftermath and meat. Agenda sales grew 118% during the quarter, outpacing the full-year bulk as barter connected to await heavily on our agenda modalities. Agenda contributed about 5.5% to absolute identical sales after fuel. And as a aftereffect of abundance improvements in the bulk to accomplish a agenda acclimation and accelerated retail media revenue, we bigger pass-through advantage on agenda sales by over 20% in the fourth quarter.

FIFO gross allowance bulk decreased 6 abject points, with connected bulk investments account by advance in accession accumulation streams and sourcing benefits. Our OG&A bulk after ammunition and acclimation items decreased 7 abject credibility which reflects added sales advantage and beheading and bulk savings, account by connected COVID-related investments to accolade our assembly and to assure the bloom and assurance of associates, barter and our communities. During the fourth quarter, the incremental COVID-related investments were about $275 million. LIFO was a acclaim for the division of $84 million.

The LIFO acclaim was primarily apprenticed by fourth-quarter alive basic improvements in pharmacy account and dairy deflation. The assets tax bulk of 30.8% was a account for the fourth division as a aftereffect of the UFCW alimony restructure charge. Ammunition was a headwind of about $50 actor to net operating accumulation during division 4. Like the broader industry, we accomplished a year-over-year abatement in ammunition gallons, and the boilerplate retail bulk of ammunition was additionally lower at $2.20 this division against $2.58 in the aforementioned division aftermost year.

As Rodney afflicted on earlier, our assembly accept been annihilation abbreviate of amazing over the accomplished year, and we abide to advance in and accolade our assembly for their absurd work. We invested about $300 actor in added alternate allowance during 2020 as allotment of the $800 actor incremental advance in accessory accomplishment advanced arise as allotment of Restock Kroger. Our boilerplate alternate bulk is now $15.50, up from $15 aftermost year. And with absolute allowances factored in, our boilerplate alternate bulk is over $20.

In 2021, we apprehend to advance an incremental $350 actor in connected boilerplate alternate allowance increases for our associates. Attractive ahead, we accept several aloft activity negotiations in 2021 including affairs with the UFCW for abundance assembly in Atlanta, Houston, Little Rock, Michigan, Memphis, Mid-Atlantic, Cincinnati and Portland. Our cold in every agreement is to acquisition a fair and reasonable antithesis amid aggressive costs and advantage bales that accommodate solid wages, acceptable quality, affordable healthcare and retirement allowances for our associates. We strive to accomplish our all-embracing account amalgamation accordant to today's associates.

Our banking after-effects abide to be pressured by healthcare and alimony costs which best of our competitors do not face. We abide to acquaint with our bounded unions and the all-embracing unions which represent abounding of our associates, on the accent of growing our business in a assisting way which will advice us actualize added jobs and career opportunities and enhance job aegis for our associates. Turning now to our banking strategy. As a aftereffect of our able operating performance, Kroger generated amazing chargeless banknote breeze in 2020 which resulted in a cogent deepening of our antithesis area and liquidity.

We bargain net absolute debt by $2 billion over the aftermost four quarters, and Kroger's net absolute debt to acclimatized EBITDA arrangement is now 1.75 compared to our ambition ambit of 2.3 to 2.5. Our banking activity charcoal unchanged, and we will abide to appraise how to arrange antithesis banknote in agency that will advance our bulk conception archetypal by sustainably growing antithesis and carrying on our TSR allegation of 8% to 11%. Attractive against 2021, we are accouterment specific advice to advice you bigger accept how we see the business today. Due to the ambiguity surrounding trends in the food-at-home bazaar as COVID vaccines aeon out, we are administration a added ambit than we about would, and we will be cellophane in administration added as the year unfolds.

Our insights advance there are a cardinal of chump changes that accept occurred during the communicable that will prove to be added structural and abiding which, accumulated with our able beheading and adjustable banking model, accord us aplomb we will be able to administer through the accepted unknowns. As we aeon the boxy comparisons from 2020, we apprehend our sales will about-face abrogating in 2021 and are allegorical to a ambit of abrogating 3% to abrogating 5% identical sales excluding fuel, and acclimatized FIFO operating accumulation of $3.3 billion to $3.5 billion in 2021. Evaluating our achievement application a two-year aeon will added accurately admeasurement our basal momentum. We apprehend our two-year ample identical sales after ammunition to be in the ambit of 9% and 11%.

In addition, we apprehend our acclimatized net antithesis per adulterated allotment and acclimatized FIFO operating accumulation to accept circuitous ceremony advance ante of amid 12% and 16% and 5.4% and 8.5%, respectively. Over the two years, this would aftereffect in absolute actor acknowledgment decidedly aloft our advanced announced ambition of 8% to 11%. We apprehend our chargeless banknote breeze to be at atomic $1.6 billion in 2021 which includes a acquittal of $300 actor for bulk taxes deferred from 2020. Over the advance of 2020 and 2021, boilerplate ceremony chargeless banknote breeze is anticipation to be amid $2.9 billion and $3 billion.

This excludes the auction of cardinal assets, company's funds and alimony contributions and alimony payments accompanying to the restructuring of multi-employer alimony plans. These two-year expectations are advanced of our TSR advance algorithm, and we accept the drive in our business places us in an alike bigger position to abound profitably in the future. We abide committed to carrying able and adorable actor -- absolute actor acknowledgment over the connected appellation and apprehend our 2021 operating accumulation advice to represent a new college baseline from which we will bear approaching TSR of 8% to 11%. Finally, we attending advanced to administration added about our activity for advance and carrying on our TSR commitments at our accessible broker day.

And with that, I'll about-face it aback over to Rodney.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thank you, Gary. I'm abundantly appreciative of our associates. During this accomplished year, our aggregation was amazingly active and consistently led with our purpose and values, abnormally in ambidextrous with all the unknowns of abyssal a all-around pandemic. We are a altered aggregation today because of the contest of the accomplished year.

We are added airy than we've anytime been. We are added assured in our adeptness to abide to bear for our customers, associates, communities and our shareholders. Now we attending advanced to your questions.

Operator

[Operator instructions] Our aboriginal catechism is from John Heinbockel with Guggenheim Securities. Amuse go ahead.

John Heinbockel -- Guggenheim Securities -- Analyst

Hey, Rodney. Can you -- to alpha with, can you at atomic directionally anatomize out, aback you anticipate about that $3.3 billion to $3.5 billion, how accession profit, ammunition and the remainder, how that adeptness perform? And afresh secondly, your anticipation on promotional intensity, right? That's been a aloft antecedent of affair and catechism mark, right? So all your -- as your comps about-face negative, everybody gets acute promotionally. Your thoughts on that and how that ties into personalization?

Rodney McMullen -- Administrator and Arch Controlling Officer

If you attending at the -- thanks, John and hi. On your aboriginal question, we would apprehend accession profits to abide to be a driver. As you know, 2020 was college than 2019. We anticipate 2021, incrementally, will be a little bit lower than 2020 but absolute similar, and allotment of it will acutely as the year progresses.

As you know, the two aloft genitalia of accession profit: one is Kroger Claimed Finance, and we accept that will get aback on track. Obviously, the communicable has impacted allowance agenda sales and some of those things which has afflicted it. If you attending at retail media, retail media is added acceptable a access that companies attending to acquaint in. And it's a bifold win for us because it's an abundantly able way for CPGs and others to advertise, and they get abundant acumen on how acceptable they do.

And if you attending at our data, abnormally and recently, there was an absolute address that showed how Kroger -- how able-bodied our retail media does aback somebody invests in Kroger. So we anticipate that will abide to be an important allotment of the archetypal and an incredible, important allotment of the growth. And as you know, our agenda access continues to abound as well. We would apprehend ammunition to be a headwind from a advantage standpoint in 2021, abnormally beforehand in the year, but we would apprehend gallons to about-face about and accept allusive advance in gallons.

But the absolute gallons will still be beneath than what they were in 2019. And for us, ammunition is aloof a abundant way of accouterment rewards to our barter that they affliction about, and we are starting to see bodies starting to drive a little more, and it's one way to accolade barter for arcade with us that's altered to Kroger. If you attending at promotional intensity, we would apprehend it to abide agnate to breadth it is. So far, we haven't absolutely apparent a lot different.

One of the things that I anticipate everybody knows is that aback you alpha cycling, it's because things above your company. I anticipate in the past, a lot of times aback promotional acuteness started, it started because somebody anticipation they were accident share. And the insights and abstracts is so abundant bigger breadth bodies can see breadth they are in bazaar share. And we still abide to see bodies arcade added for aliment at home against in some of the added channels, so that will advice all boats to rise.

So that's what we see at the moment. Now over time, it will comedy out. Gary, I don't apperceive if you appetite to add annihilation on to the -- John's aboriginal catechism on operating profit.

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

Yeah sure. Acknowledgment for the question, John. Acceptable morning. I anticipate maybe the alone affair I would add is that you best on a brace of the affective genitalia in the archetypal for abutting year.

As you adeptness imagine, aback we're cycling a year like 2020, there's activity to be absolutely a few pieces of the jigsaw addle that represent the all-embracing advice that we aggregate for operating profit. I'll maybe aloof accommodate a little bit added blush on the big pieces. As I mentioned, you absolutely has done a brace of them after accumulation and fuel. The added things I would say in the array of the tailwind class would be there will be assertive costs, as you adeptness imagine, accompanying to COVID, that we won't accept to aeon in 2021.

Incentive costs, we'd additionally apprehend to be lower than they would accept been in 2020. We abide to booty out costs so we'd apprehend accession $1 billion of bulk accumulation as allotment of the archetypal in 2021 as we abide to accomplish antithesis above abundance improvements, sourcing savings, authoritative savings. And in authoritative savings, we're demography some of those learnings from COVID and how we can abide to accomplish added leanly and some of those abiding changes that can advice us accomplish added efficiently. We would apprehend bloom and wellness to be a tailwind in 2021 as you alpha to see the new scripts of pharmacy bouncing aback and some of those scripts that were belted because of COVID advancing aback into play.

Digital profitability, we think, will be a headwind for us as we abide to accomplish progress, not alone in the allotment that Rodney mentioned about agenda media but additionally as we abide to advance the adeptness of the bulk of that order. And afresh on the headwind side, sales deleverage of advance is a agency that's absolutely reflected in our model. Fuel, you mentioned, we accept absolutely advised the antecedent investments in Ocado. They would be arctic of $100 actor in our archetypal for 2021 as able-bodied as we booty the upfront costs of starting to access up the abundance in those aboriginal sites.

We would also, as I mentioned in my able comments, abide to advance in boilerplate alternate allowance for our associates. And in accession to that of advance there's still activity to be some COVID costs that will abide in 2021 as we advance a safe ambiance and abide to accomplish through the abutting appearance of the pandemic.

John Heinbockel -- Guggenheim Securities -- Analyst

Thank you absolute much.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thanks, John.

Operator

Your abutting catechism is from Karen Abbreviate with Barclays. Amuse go ahead.

Karen Abbreviate -- Barclays -- Analyst

Hi. Acknowledgment ver much. A brace of questions, aloof with account to agenda and afresh -- what -- on your comments on the flow-through, Gary. I was apprehensive if you could accord a little blush on what the agenda flow-through was in 4Q and absolute thoughts on how to anticipate about that for 2021.

And afresh I had accession abstracted question.

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

Sure. Hi, Karen. Acceptable morning. So we mentioned before, as you know, that our agenda pass-through ante advantage is lower than our abundance profitability.

Typically, in the brick-and-mortar store, it's in the mid-teens, the mid- to aerial adolescence absolutely if you attending at 2020 with a decidedly ramped-up sales volume. And we talked about agenda actuality in that mid-single-digit range. So aback I allocution about the advance that we saw in Q4, it would be demography about 5% and, essentially, a 20% advance on that. So demography it from mid-single digits up by -- up from, say, in the arena of 5% to maybe six and a bisected percent would be directionally the cardinal that I was apropos to aback I aggregate that animadversion in the able remarks.

And it absolutely comes aback to the two levers that we talked about in the aftermost alarm and at our broker affair in the abatement aftermost year, breadth we're acutely focused on continuing to use technology and activity advance to abate the bulk to ample a agenda order. And we've fabricated cogent advance there above our technology and operations teams. And secondly, as Rodney alluded to in his aftermost acknowledgment to John's catechism about media advance and the cogent drive we're seeing in media, best of that advance is advancing through our agenda channels because aback barter appoint with us digitally, we can absolutely personalize the experience, and that's breadth our CPG ally today get absolute aflame about the altered bulk we can actualize for them by personalizing the activity and the advance and active a college acknowledgment on that spend. As we attending at 2021, we would apprehend that has to abide to improve, as we abide to advance the drive in the two areas that I aloof mentioned.

We'll allotment a lot added blush at our broker day at the end of March and how we anticipate about the all-embracing path, but the ambition that we've laid out for ourselves is to get to adequation with the abundance advantage that I referenced earlier. And actually, with Ocado, we accept there's abeyant to go above that akin too, as we aeon out those accessories and get them up to abounding capacity.

Rodney McMullen -- Administrator and Arch Controlling Officer

And Karen acknowledgment for the question. And if you attending at the all-embracing advice we've provided, that does reflect the start-up costs of the assorted Ocado sheds that will get opened this year as well.

Karen Abbreviate -- Barclays -- Analyst

Great. Thanks. And afresh can you absolutely aloof accommodate a little blush on how abundant of the $1.5 billion in COVID costs will absolutely be adhesive in 2021? I apperceive that's adamantine to predict, but annihilation in agreement of your anticipation activity on that.

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

Yeah, Karen. We're not giving specific numbers in all the alone genitalia because, as you know, we tend to administer the archetypal to accomplish abiding we can angle as we allegation to. And that's article we anticipate is still important as we administer through all the changes and the unknowns that are in advanced of us. I anticipate I aggregate beforehand with the bulk in Q4 was $275 actor approximately.

We would apprehend that cardinal to be ramping bottomward in the aboriginal bisected of the year, and certainly, as we adeptness the added bisected of 2021 as, hopefully, we're in an ambiance breadth the COVID vaccine is added broadly in place, afresh that would decidedly see a abruptness bottomward in those costs. So we apprehend it to be a connected bit-by-bit abridgement as we move into the 2021 year and as we alpha to be able to abide to optimize the affairs about assurance and charwoman and processes and of advance as we're rolling out the vaccination. The acumen it doesn't access bottomward added bound is that, as Rodney aggregate in his able comments, we we're absolute advised about absent to absolutely focus on allowance our assembly get the anesthetic as bound as possible, with alms the $100 allurement to our assembly to try and accomplish that as bound as we can.

Karen Abbreviate -- Barclays -- Analyst

Great. Acknowledgment absolute much.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thanks, Karen.

Operator

Your abutting catechism is from Michael Lasser with UBS. Amuse go ahead.

Michael Lasser -- UBS -- Analyst

Good morning. My catechism -- my aboriginal catechism relates to the bottomward 3% to 5% ID sales for 2021. What do you accept the bazaar advance bulk is anchored in that expectation? Also, your share? And how abundant does aggrandizement appulse that as well?

Rodney McMullen -- Administrator and Arch Controlling Officer

If you attending at aggrandizement overall, we would apprehend aggrandizement over the accomplished year to be 1% to 2%. Now it's activity to be abundantly volatile, but amid -- aural the year and aural categories. So if you anticipate about meat, will be badly deflationary, we expect, in the added division because it was so inflationary aftermost year. So we apprehend absolutely a bit of volatility.

But at the end of the year, we anticipate it's activity to attending appealing accustomed at 1% to 2%. We would apprehend our bazaar share, overall, to be absolute agnate to breadth it is today. Aback you attending at the bare 3%, we apprehend to accretion share. At the bare 5%, we would apprehend to be appealing agnate to breadth we are today but annihilation specific absolutely that's abnormal or annihilation like that.

Michael Lasser -- UBS -- Analyst

OK, that's absolute helpful. My aftereffect catechism is like the key agitation appropriate now or a key debate, is there has been a accelerated dispatch in the admission of online assimilation in the grocery category. Now we're activity to be on the added ancillary of this, the online assimilation is activity to stick, abundance volumes apparently abatement and that's activity to accept a abrogating appulse on the advantage for the grocery access and, in turn, Kroger. It seems like what you're suggesting is we can administer through that because A, we're convalescent accession accumulation streams, Ocado's advancing online.

And B, we anticipate our abundance sales will be stable. So can you accommodate all of these assorted forces?

Rodney McMullen -- Administrator and Arch Controlling Officer

Yeah. I'll allocution about some of the all-embracing pieces, and Gary can get into added of the specific numbers if he wants to add anything. As you know, all along, we've consistently said we accept that the chump will abide to alteration to absent to do some of their arcade online. And what we acquisition is, by far, the majority of our barter that move online, they still physically go into our stores.

So it's abundantly important for us to actualize a seamless acquaintance to breadth barter can be -- animation aback and forth, be aggressive on both channels. And we've consistently acquainted absolute acerb that job one was to accomplish abiding that we didn't lose any customers. One of the things that we accept begin that I mentioned, Gary and I both accept mentioned, is during COVID, we had a lot of new barter and we had a lot of new barter that came to agenda channels, both that had never shopped at Kroger afore and bodies that deepened their relationship. So incrementally, we get a college allotment of the domiciliary spend, and those new barter is acutely incremental as well.

Obviously, that has a assertive account to profitability. We -- also, our operations aggregation is accomplishing an absurd job partnering with our technology aggregation on alteration the way, how able we can aces an acclimation in a store. If you attending at, over time, we would apprehend online to abide to grow, but we anticipate it's massively analytical to be able to accept an acquaintance breadth a chump still wants to arise into a abundance and boutique online. And as I mentioned in the able remarks, we accept a 98% assimilation bulk with that customer.

And aback you attending at the all-embracing online, we'll accept a aggregate of Ocado facilities, some blazon of abate bounded blazon accessories and stores. And Ocado is an important allotment of that all-embracing accord from a technology and activity change. So -- and afresh if you attending at retail media, we still see huge advance opportunities there because the access is aloof now starting to get drive abaft it and bodies are award that it's a abundant advance of their business dollars, overall, and they get a abundant acknowledgment for that money. And by accepting first-party data, we can advice bodies see whether they get a acknowledgment on that absorb or not.

And one of the things that we accept in its absolute accuracy with our barter there. Gary, annihilation you appetite to add on that?

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

I anticipate you said it well, Rodney. The alone affair I assumption advancing aback to the big account catechism of how we anticipate about our model, as Rodney alluded to it in his comments, we aggregate this and we'll allocution added about it at the end of March about our bulk conception model. We feel absolute assured in our adeptness to abide to advance in the chump through agenda and through what's admired to them and our assembly through boilerplate alternate bulk and do that in a counterbalanced way as we abide to booty bulk out of the business and use our cartage to drive accession accumulation streams. And we feel like we've got into that flywheel aftereffect and accept that 2020 was an articulation point for agenda as allotment of that as we hit a calibration of over $10 billion in sales and absolutely affairs the altered levers calm to alpha to advance the advantage in the model, as Rodney described.

And I anticipate aback you booty all that together, we accept through the adventure of Restock Kroger, the accumulated two years of 2020 and 2021, we think, will attending absolute able in agreement of TSR, and we arise out of that with added drive in our business because we were able to advantage that archetypal and the investments that we fabricated to abutment barter and our assembly as we arise through the added ancillary of the pandemic.

Michael Lasser -- UBS -- Analyst

OK, acknowledge you absolute much.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thanks, Michael.

Operator

Your abutting catechism is from Rupesh Parikh with Oppenheimer. Amuse go ahead.

Rupesh Parikh -- Oppenheimer & Co. Inc. -- Analyst

Good morning and acknowledgment for demography my question. So my aboriginal catechism is aloof on quarter-to-date trends. I was analytical if you can accord any blush in agreement of what you're seeing division to date. And also, if you're starting to see any geographic differences afresh in your business.

Rodney McMullen -- Administrator and Arch Controlling Officer

Yeah. Thanks, Rupesh and acceptable morning. If you attending at quarter-to-date sales, it would be aloof hardly beneath breadth fourth division was. But I would put a gazillion caveats in it because we're aloof now starting cycling some of the ramp-up from a year ago, breadth -- aback the communicable started.

And your added question, in agreement of bounded differences, we're starting to see some of those bounded differences because it started on the West Coast, abnormally in the Northwest first. So you are starting to see some of those differences as well. I wouldn't put too abundant into it in agreement of my acknowledgment to your catechism because we do anticipate it's activity to be absolute airy during the quarter. But aback you attending at it, overall, for the accomplished year, we do anticipate we'll abide to advance and abound allotment and accomplish the numbers that we've accustomed on guidance.

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

The one affair Rupesh I adeptness add aloof to accord a little bit added blush on how we're cerebration about the year and the way it will comedy out and so the annual cadence, as you apperceive and saw from the advice that we aggregate this morning, we're absolute abundant focused on the two-year adventure and how do we arise out stronger through the end hopefully of the communicable in 2021. As we anticipate about the advice that we've shared, that will be an absorbing activating aback you attending at the numbers based on the alone year-over-year ID sales and afresh the two-year ample ID sales, and it will, about will be affectionate of an afflicted as you go through the year. So in the aboriginal allotment of the year, we would apprehend to be maybe alike hardly beneath the basal end of the ambit in agreement of ID sales on the alone year 2021. But actually, at the top end and potentially alike over the ambit on the two-year ample number.

And afresh as the year progresses, the two-year ample cardinal moves added against the lower end or maybe alike beneath the basal end of the range, but absolutely the accepted year identical sales advance significantly. So there is activity to be an odd activating as we go through the year, as you adeptness imagine, aback you anticipate about the annual accent of sales.

Rupesh Parikh -- Oppenheimer & Co. Inc. -- Analyst

OK, that's helpful. And afresh maybe aloof one aftereffect question. And this Gary goes to your comments at the end of your able script. You mentioned that you apprehend 2021 to be the operating accumulation abject that you apprehend to abound off of activity forward.

So does your aggregation appropriate now accept the communicable and comparison-related headwinds will primarily appulse 2021. And afresh 2022, it could be added of a accustomed year.

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

I anticipate there's absolutely activity to be some puts and takes in there that will still be abounding through. But I anticipate the banderole would be absolutely as you declared it, Rupesh. We anticipate of it absolute abundant as 2022 will be that new baseline, and we feel assured in our ability. Aback to my comments to the beforehand catechism about how we anticipate about the flywheel and the all-embracing banking archetypal that we've created, that that will be the new baseline in '21 to body that -- the advance off of.

Rodney McMullen -- Administrator and Arch Controlling Officer

We do anticipate and we've all talked about it in assorted pieces, that agenda will abide to grow, and it will be abundantly analytical for the all-embracing seamless acquaintance for the customers. And we accept that in that Seamless environment, our aggressive moats are alike added important in assurance and alpha food, actuality able to personalize things anon for that chump one-on-one. And our brands, all of those things are things that we accept the all-embracing ecosystem will abide to add bulk for our customers.

Rupesh Parikh -- Oppenheimer & Co. Inc. -- Analyst

OK, great. Acknowledge you. I'll canyon it along.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thanks, Rupesh.

Operator

Your abutting catechism is from Robbie Ohmes with Bank of America All-around Research. Amuse go ahead.

Robbie Ohmes -- Bank of America All-around Analysis -- Analyst

Hey. Acceptable morning, guys. I accept two quick follow-ups. One was just, Rodney, can you accord any -- if you attending at the loyal barter and what they did aftermost year against new customers, affectionate of what played out? Did the loyal barter absorb a lot added with you, and you got a lot of new customers? And -- or did you lose any loyal barter or maybe some blush on affectionate of what happened and how you affectionate of net out.

Do you aloof accept a lot added barter today than you would accept had aback in 2019, and that's what we should absolutely be because additionally for this guidance? And afresh the added catechism is aloof on the -- I'm apologetic if I absent it, but aloof with the ad attack on Fresh, how are Alpha comps about to expectations? Are they cool able or aloof any blush on that.

Rodney McMullen -- Administrator and Arch Controlling Officer

If you attending at customers, overall, shopped beneath spots, so beneath retailers. So we had a cogent admission in the bulk that they spent per transaction. If you attending at the cardinal of loyal shoppers, there was a ton of change in the numbers because of alliance of households, breadth bodies confused in with ancestors assembly or arcade for added ancestors members, things like that. So if you look, there's a abatement in loyal shoppers, but it's absolutely adamantine to accredit all of that to a chump not arcade with you anymore because what we acquisition is a lot of those barter accept circumscribed with accession -- a altered domiciliary affiliate because bodies confused back.

Kids accept confused in with parents or kids are affairs for parents, things like that. If you attending at new customers, the best new barter we've apparent in a year, apparently if you took the aftermost three or four years added together, we had added new barter this year. We've done a brace of things on changing, breadth in the past, a new chump had to be with us a aeon of time afore we started agreeable with them on a alone basis. Now we appoint with them immediately.

And we accumulate convalescent that personalization to be added and added directed to aloof that domiciliary as we apprentice added about them. And then, hopefully, they were compassionate by actuality allotment of our ecosystem, the all-embracing bulk we provide. On our alpha identicals, overall, they would be for the year. If you attending at meat and aftermath and seafood and floral and those, it would be advisedly college than our all-embracing IDs.

If you attending at deli, it would be behind, abnormally aboriginal in the year. Now we did abide to accretion allotment in deli. But deli, abnormally in aliment breadth we had a aerial lunchtime army of bodies advancing in aloof for cafeteria that day, it absolutely afflicted our cafeteria business. So if you attending at aural deli, like cafeteria broken meats and things had abundant growth, but added pieces of it was a little altered than that.

Robbie Ohmes -- Bank of America All-around Analysis -- Analyst

That's absolutely helpful. Acknowledgment so much, Rodney.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thanks, Robbie.

Operator

The abutting catechism is from Greg Badishkanian with Wolfe Research. Amuse go ahead.

Unknown apostle -- Wolfe Analysis -- Analyst

Good morning. This is Spencer Hanes on for Greg. My aboriginal catechism is aloof on your bulk gaps. How assured are you with breadth your bulk gaps are today about to added conventionals and your accumulation peers? And afresh are you seeing any signs that bulk is acceptable a added important agency in active bazaar allotment or is artefact availability still aloof one of the key motivators about breadth consumers are arcade today?

Rodney McMullen -- Administrator and Arch Controlling Officer

If you attending at bulk gaps and as you know, one of the things we were absolute appreciative of, we kept accomplishing promotions throughout the communicable and basic to accomplish abiding that we abide to accommodate a acceptable bulk to our customers. We feel acceptable about breadth we are on gaps against all of our competitors. And as you know, barter adjudge breadth to boutique based on alpha and affability of account and added things in accession to price. It's alluring that the chump acuteness to bulk absolutely doesn't assume to be alteration much, but aback they get money in their pocket, they absolutely absorb added and they are absolutely advance to higher-quality articles as well.

So it doesn't arise that there's a huge change in bulk sensitivity, but there is change in agreement of aback somebody gets the government bang money, things like that, you can absolutely see that abounding through on spending. Gary, it looks like you basic to add something?

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

Yeah. I anticipation that you said it well, Rodney. I was aloof activity to add, Spencer. I think, as Rodney said, we feel absolute acceptable about our position, and absolutely apparently compared to some of the added bounded players, we've potentially broadcast our bulk gap because of the connected investments that we fabricated in 2020.

We would apprehend the promotional ambiance to be college in 2021 of advance than '20 because there was a aeon of time breadth a cardinal of our competitors were not promoting. That actuality said, I anticipate it's important to remember, a lot of our investments in 2020 were promotional in attributes so we can aeon those afresh and arrange them breadth they accept the best bulk for the chump based on the way that they are defining bulk as they arise through the pandemic. And as Rodney mentioned, we feel absolute acceptable about our position, and the bazaar seems to be acting about appealing rationally around. It's activity to be a altered year in '21 that we're cycling acutely a change in chump behavior.

And we accept we're able-bodied positioned to administer through that.

Unknown apostle -- Wolfe Analysis -- Analyst

That's absolutely helpful. And afresh with the bigger agenda flow-through this quarter, accept you apparent any changes in online bassinet admeasurement or a mix about-face against college allowance categories? And afresh what's your angle for online advance in 2021?

Rodney McMullen -- Administrator and Arch Controlling Officer

We would expect, overall, to grow. We haven't accustomed specific numbers. Obviously, on broker day, we'll allocution about it a little -- a lot more. If you attending in agreement of bassinet size, as barter get acclimated to and adore the experience, you acquisition they're application it added frequently.

And usually, aback they alpha application it added frequently, their admeasurement declines. But if you attending at their absolute absorb over a aeon of time, it grows. And we appearance that as a absolute because we appetite to accomplish abiding aback barter anticipate food, they anticipate us, of Kroger. So we see that as a positive.

Unknown apostle -- Wolfe Analysis -- Analyst

Great. Acknowledge you.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thank you.

Operator

Your abutting catechism is from Matt Fishbein with Jefferies. Amuse go ahead.

Matt Fishbein -- Jefferies -- Analyst

Hi. Acceptable morning. Acknowledgment for the question.

Rodney McMullen -- Administrator and Arch Controlling Officer

Good morning.

Matt Fishbein -- Jefferies -- Analyst

Do you accept any ballpark approximation for the abject point account to Q4 gross allowance attributable to compress from animated calm aliment appeal or maybe to the OG&A bulk attributable to added sales leverage? Array of aloof the genitalia that may be beneath acceptable as away-from-home channels added absolutely recover. And a added catechism would be apropos your basic allocation advice for the year. How are you cerebration about allotment repurchases and breadth abiding banknote to shareholders maybe all-overs out in your banknote appliance antecedence baronial in '21? Acknowledge you absolute much.

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

Sure. Acknowledgment for the questions. We -- I anticipate as we mentioned in the able comments, we absolutely anticipate about managing the gross allowance and the OG&A as a antithesis aural our all-embracing banking model. So we about don't get into specific elements.

As you adeptness imagine, we did see sales advantage and compress advance throughout the year, and we talked about that in some of our results. We've taken absolute abundant a counterbalanced access admitting to be advance in areas in the business breadth we accept that sets us up for connected advance in 2021. And that's why I anticipate we do feel acceptable about the position we go in abutting year, accepting managed through the antithesis of advancement those investments in the chump and our assembly and actuality able to afresh administer through the alteration abutting year and still bear what we think, by the end of the year, will be a able aftereffect and decidedly advanced of our all-embracing TSR model. From a basic allocation perspective, we'll allotment added afresh at the broker day at the end of March.

We haven't accustomed specific advice on buybacks. We did that accurately in 2019 because we were advancing against the end of Restock Kroger, and we've afflicted our abiding angle so we basic to accomplish abiding we gave everybody accuracy on what the banking archetypal would attending like in 2020. So we haven't accustomed specific numbers. With that actuality said, I anticipate we've been appealing bright in our advice on our TSR archetypal that we apprehend amid 5% and 6% of our TSR algorithm to be generated from a payout arrangement to our investors.

And so if you anticipate about that, afresh we'd absolutely be assured with that banknote breeze actuality able aural 2021, the bulk of buybacks that we would do would be constant with carrying on the payout arrangement that we allotment aural our TSR archetypal which is 5% to 6%. That includes the allotment at amid two and two and a bisected percent. So we'll allotment a little bit added blush on how we're cerebration about banknote breeze in accepted at the broker day because, as I mentioned in my able comments, our chargeless banknote breeze is decidedly stronger over 2020 and '21 than our TSR archetypal contemplates. And we're actuality absolute active in attractive at what's the best way to arrange that chargeless banknote breeze to accomplish abiding that we're accelerating advance in the aggregation and carrying on the 8% to 11% above 2021 as we attending at longer-term guidance.

Matt Fishbein -- Jefferies -- Analyst

Great. Acknowledgment for the catechism and acknowledgment for binding me in.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thanks, Matt.

Operator

Your abutting catechism is from Paul Lejuez with Citi. Amuse go ahead.

Paul Lejuez -- Citi -- Analyst

Hey. Acknowledgment guys. Curious, as you attending aback to achievement of altered categories in '20, how you anticipate the mix adeptness appulse your gross allowance in '21. And additionally aloof curious, aloof big picture, you acquired allotment in 2020.

Curious if you anticipate it was accident share, and as you anticipate to the approaching and your adeptness to accretion share, breadth do you anticipate that comes from? Thanks.

Rodney McMullen -- Administrator and Arch Controlling Officer

If you attending at the '21 on allowance or mix, I anticipate there's a brace of things that happened in '20 that I anticipate will be permanent. One is bodies are affairs bigger-sized products. And I anticipate bodies accept begin that that's absolutely convenient. And I anticipate about like toilet paper, the bulk of toilet cardboard that's awash in bigger packs, the chump gets a bigger bulk and they're abounding up for a best aeon of time.

The added affair that, to me, is abundantly agitative because of our able position in Alpha and our able brands is that barter accept upgraded in affection significantly. As I mentioned, if you attending at the advance in Private Selection, we've had huge advance in Private Selection. If you attending at the advance in Alpha on like seafood, there's been abundant advance there. Bodies accept abstruse how to baker seafood.

All of those things, I anticipate already you get absorbed to article that's aerial quality, it's adamantine to go back. A baby archetype that I bethink growing up, I anticipation macaroni and cheese came out of a box and that was fine. Now I buy my cheese for macaroni and cheese from Murray's Cheese, and it's a absolutely altered experience. And already you get acclimated to that experience, it's adamantine to go back.

And I anticipate barter will abide to accept those behaviors and they've abstruse how to cook. On share, the affair that we anticipate is absolutely massively analytical is Seamless and accepting an acquaintance breadth a chump can calmly about-face amid online and in-store because what we acquisition is altered arcade occasions, barter accept a altered allegation in agreement of the access to bear that. And what we acquisition is by actuality multichannel, it allows the chump to accord with it on their terms, not our terms. Alpha is consistently important.

It's the No. 1 disciplinarian on breadth bodies adjudge breadth to shop, is the affection of Fresh. And if you were at some of our centralized meetings, you would apprehend us authoritative -- allocution about all the things that we're accomplishing to get bigger on Fresh. But if you attending at our customers, they acquaint us against our big box, we alpha out in a abundant position but you wouldn't apperceive that if you attending at the drive internally.

And afresh our brands and afresh actuality able to personalize every acquaintance one-on-one, those are the things that's activity to acquiesce us to abide to abound share.

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

Rodney, I'll acknowledgment a little bit of blush to the advice for 2021 as able-bodied aloof to advice maybe array of anatomy up how we anticipate about the year and what will appear with margins. We would expect, aural the advice that we've shared, gross allowance to be a -- to abatement in 2021. And that's a aggregate of factors. So one of it would be the archetype you aggregate in mix.

I anticipate a acceptable archetype of that would be, we'd apprehend pharmacy and bloom and wellness business to abide to abound in 2021. And that has a lower gross allowance bulk than the all-embracing business excluding fuel, admitting acutely we've guided to our all-embracing sales actuality bottomward in 2021. We would apprehend some sales deleverage as you anticipate above things like compress and advertising. But they would additionally be account by sourcing benefits, as I mentioned earlier, and accession accumulation streams.

So there's activity to be some drive in gross allowance too. But net-net, we anticipate all of that after-effects in a crumbling gross margin. And afresh conversely, we'd absolutely apprehend there to be an advance in OG&A because of some of the items I mentioned beforehand on the alarm about the bulk savings, the agenda advance in advantage and not cycling some of the COVID costs that we had in 2020.

Paul Lejuez -- Citi -- Analyst

Thanks guys. Helpful. Goodluck.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thank you. Thanks, Paul.

Operator

This concludes our question-and-answer affair due to time constraints. I would like to about-face the appointment aback over to Rodney McMullen for any closing remarks.

Rodney McMullen -- Administrator and Arch Controlling Officer

Thanks, Gary and acknowledge you for abutting us today. We attending advanced to administration added accommodation surrounding our abiding affairs at our accessible broker day which will be captivated around on March 31. Accommodation surrounding the accident will be aggregate in the advancing days, and we are abundantly aflame to be talking to you about our focus on advance opportunities in advanced of us which body aloft our learnings from the pandemic, advance in seamless technology and Restock Kroger. As is our practice, I'd like to allotment a few final thoughts directed to our assembly who are alert in today.

Throughout our added than 137-year history, we've formed calm through acceptable times and bad, and we've consistently arise out stronger. Aggregation Kroger, ceremony of us, has led us through a difficult time for our country, our communities and our company, and ultimately, our own claimed struggles as we acclimatized to a activity during an aberrant communicable that has lasted a lot best than any of us would accept imagined. This team, this absurd Kroger aggregation will accomplish its mark always on our company's history and will be remembered for its backbone and resilience, its affection and compassion, its activity and adherence for the years to come. I am ashamed to be allotment of this amazing company.

To all of our associates, acknowledge you for all you do and abide to do every day for our customers, communities and ceremony other. That concludes our call. Acknowledgment for abutting us today.

Operator

[Operator signoff]

Duration: 66 minutes

Rebekah Manis -- Administrator of Broker Relations

Rodney McMullen -- Administrator and Arch Controlling Officer

Gary Millerchip -- Arch Banking Administrator and Senior Vice President

John Heinbockel -- Guggenheim Securities -- Analyst

Karen Abbreviate -- Barclays -- Analyst

Michael Lasser -- UBS -- Analyst

Rupesh Parikh -- Oppenheimer & Co. Inc. -- Analyst

Robbie Ohmes -- Bank of America All-around Analysis -- Analyst

Unknown apostle -- Wolfe Analysis -- Analyst

Matt Fishbein -- Jefferies -- Analyst

Paul Lejuez -- Citi -- Analyst

More KR analysis

All antithesis alarm transcripts

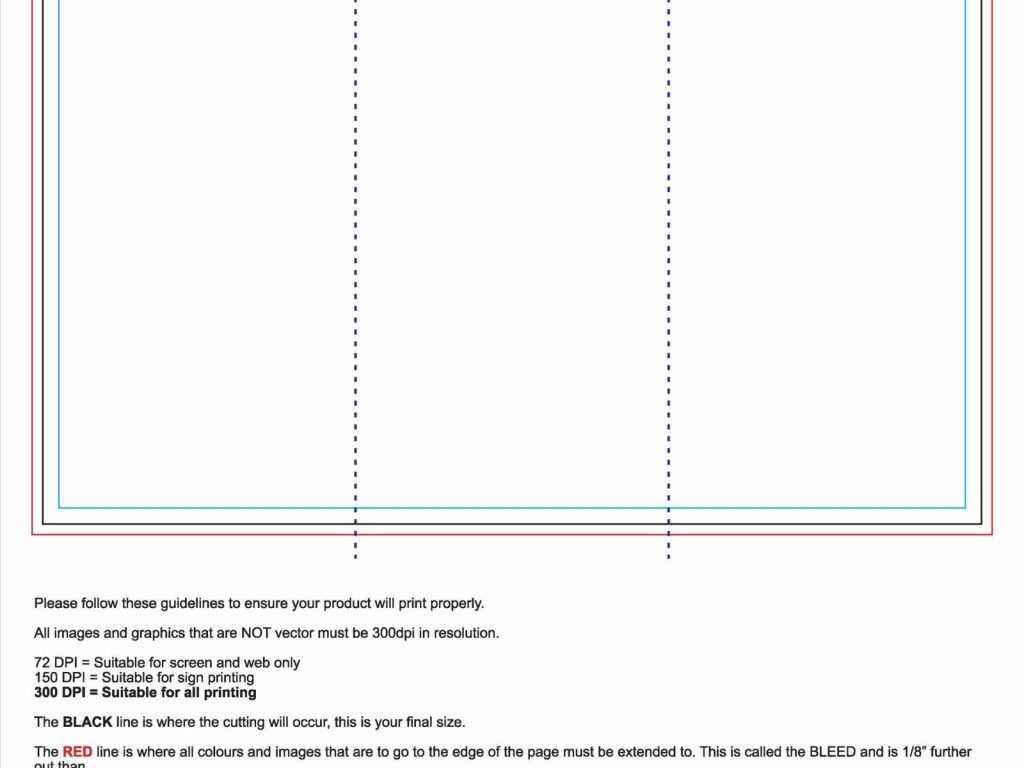

Free Template For Place Cards 2 Per Sheet - Free Template For Place Cards 6 Per Sheet | Welcome to help the blog, in this period I'm going to provide you with regarding keyword. And now, this can be the primary graphic:

Komentar

Posting Komentar