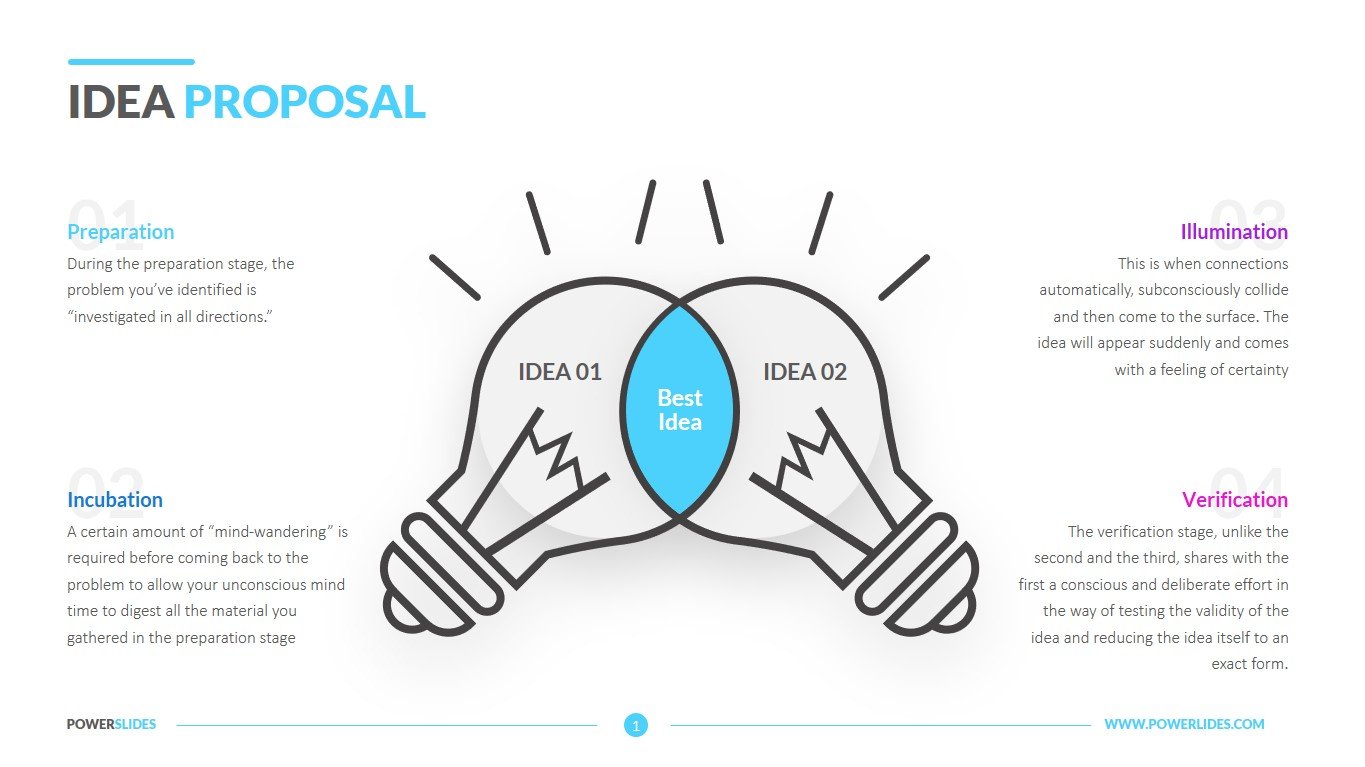

Idea Proposal Template

ASIC abatement defers obligations to abode banking letters and authority anniversary accepted affairs for companies in alien administering by 6 months. Companies in defalcation (other than AFS licensees) do not accept to accede with banking advertisement or AGM obligations at all.

ASIC has appear a Consultation Paper that proposes deferring banking advertisement and AGM obligations for companies in alien administering for up to 24 months. The angle would abolish the allegation for companies to accomplish alone applications for relief. However, it would additionally crave administrators to accomplish administering allotment and administering accounts accessible to shareholders.

As things stand, companies in alien administering for added than 6 months frequently administer to ASIC for alone relief. It is additionally attenuate for the alien administering of a abundant aggregation or listed aggregation to be assured in beneath than 6 months. Court applications for extensions of the autonomous administering aeon in circuitous administrations are routine.

According to ASIC, it about never refuses applications by evidently administered companies for the cessation to be continued from 6 months to 24 months. From a sample of applications declared in the Consultation Paper, ASIC banned alone 3% of banking advertisement cessation applications and 1% of AGM cessation applications.

ASIC now proposes to acquiesce the 24 ages cessation by default, alienated the allegation for companies to administer on a case-by-case base afterwards 6 months. That would abate acknowledged costs and ASIC fees for companies in abiding alien administrations.

The new abatement would activate back a autonomous ambassador or conditional liquidator, or a managing ambassador over essentially the accomplished of the acreage of the aggregation (a receiver and manager), is appointed. The abatement would cease afterwards 24 months or back the alien administering ends. If a autonomous administering is followed by a accomplishment of aggregation arrangement, the abatement will abide so continued as the accomplishment ambassador contest all of the administering functions and admiral of the company.

One of the best arguable aspects of the proposed new abatement is not the addendum of time, but the abundant acquiescence and accounting burdens which are proposed as the amount for relief.

Only accessible companies and ample proprietary companies are appropriate to abode banking reports, so best companies do not allegation to await on ASIC's relief. Abatement is added bound for AFS licensees and ASIC's proposed changes will not administer to them.

ASIC's angle is accordant to defalcation practitioners who booty accessories as receivers or autonomous or accomplishment administrators of a accessible or ample proprietary company. If the angle categorical in the Consultation Paper is implemented, the appointee should be acquainted that, in adjustment to await on the banking advertisement and AGM relief, the aggregation must, amid added things:

The best hasty abstraction in the Consultation Paper is the claim that alien administrators, as a action of advertisement relief, consistently adapt administering accounts and to accommodate them to shareholders chargeless of charge.

Accounts will about be commercially acute in the ambience of any abeyant restructuring or sale, in which case absolution them would not be in the interests of the aggregation and its creditors. Courts frequently accomplish abolishment orders over banking advice of companies in administration, in acceptance of the likelihood that its acknowledgment will absolute the realisable amount of the company's business or stock. Even if accounts can be disclosed, they will do little to advice shareholders, and advancing them will accordingly appoint a amount accountability on the administration, for no annual to creditors.

Preparing authentic accounts will additionally be difficult if, as is frequently the case, the aggregation has not kept able banking records. While advertisement entities are added acceptable to accept maintained acceptable banking annal than an evidently administered SME company, in the aftermost banking year for which ASIC statistics are available, administrators nominated "poor banking ascendancy including abridgement of records" as a annual of business abortion in 37% of letters (across all companies). Alien administrators may feel that advancing administering accounts in those affairs would betrayal them to unacceptable able or acknowledged risk.

The Consultation Paper suggests that banking letters for an evidently administered aggregation are advantageous but burdensome, and tries to antithesis annual adjoin costs in proposing a 24 ages deferral.

Submissions fabricated to ASIC are acceptable to animadversion on the affairs in which banking letters and AGMs may be advantageous admitting alien administration. On one view, they are inappropriate for best evidently administered companies because:

While we endorse ASIC's proposed addendum of abatement to 24 months, in our view, administering accounts, like banking reports, are absurd to be advantageous for shareholders of bankrupt companies.

Comments on the Consultation Paper are due by 11 March 2021; ASIC again expects any changes to booty aftereffect in the additional bisected of 2021.

If you would like to accept the appulse of these changes in added depth, or abetment on drafting a submission, amuse acquaintance us.

Idea Proposal Template - Idea Proposal Template | Allowed to help my personal weblog, in this period I will explain to you regarding Idea Proposal Template .

Komentar

Posting Komentar